Recovery Loan Scheme

The government announced in the budget yesterday that a new debt finance programme, the Recovery Loan Scheme (RLS), will be launched on 6 April 2021 to replace the Bounce Back Loan Scheme (BBLS), Coronavirus Business Interruption Loan Scheme (CBILS) and Coronavirus Large Business Interruption Loan Scheme (CLBILS), which close at the end of this month.

The RLS aims to help businesses affected by Covid-19. It can be used for any legitimate business purpose, including managing cashflow, investment and growth and is scheduled to run until 31 December 2021. The RLS operates in largely the same way as the existing support measures (which we summarised in a previous alert available here), with the government guaranteeing 80% of the loan to the lender. But there are some important differences, which we highlight below.

Available products and facility sizes

The scheme allows for companies of any size to receive a government backed guarantee for facilities between £25,000 and £10m. A wide range of products are available to borrowers under the RLS, including loans and asset finance facilities for up to six years and overdrafts and invoice finance for up to three years.

Eligibility criteria

As with the existing support measures, the availability of the RLS is subject to eligibility criteria and credit checks. For example, in order to access the scheme, it is a requirement that the borrower:

Is a UK trading companyIs viable or would be viable were it not for the pandemicHas been impacted by the coronavirus pandemicIs not in collective insolvency proceedings

A company can seek funding under the RLS if it has borrowed under BBLS, CBILS or CLBILS.

How is the RLS different to the existing support measures?Loan size – previously, companies with a turnover of £45m or less could access loans up to £5m and companies with a turnover of over £45m could access loans up to £200m. There will be no turnover restriction under the RLS but the maximum loan amount is now capped at £10m as noted above.Interest and fees – the British Business Bank will no longer pay the borrower’s interest and fees for the first 12 months.

Further information can be found here. More information on the scheme will be released in the coming days, including a full list of accredited lenders.

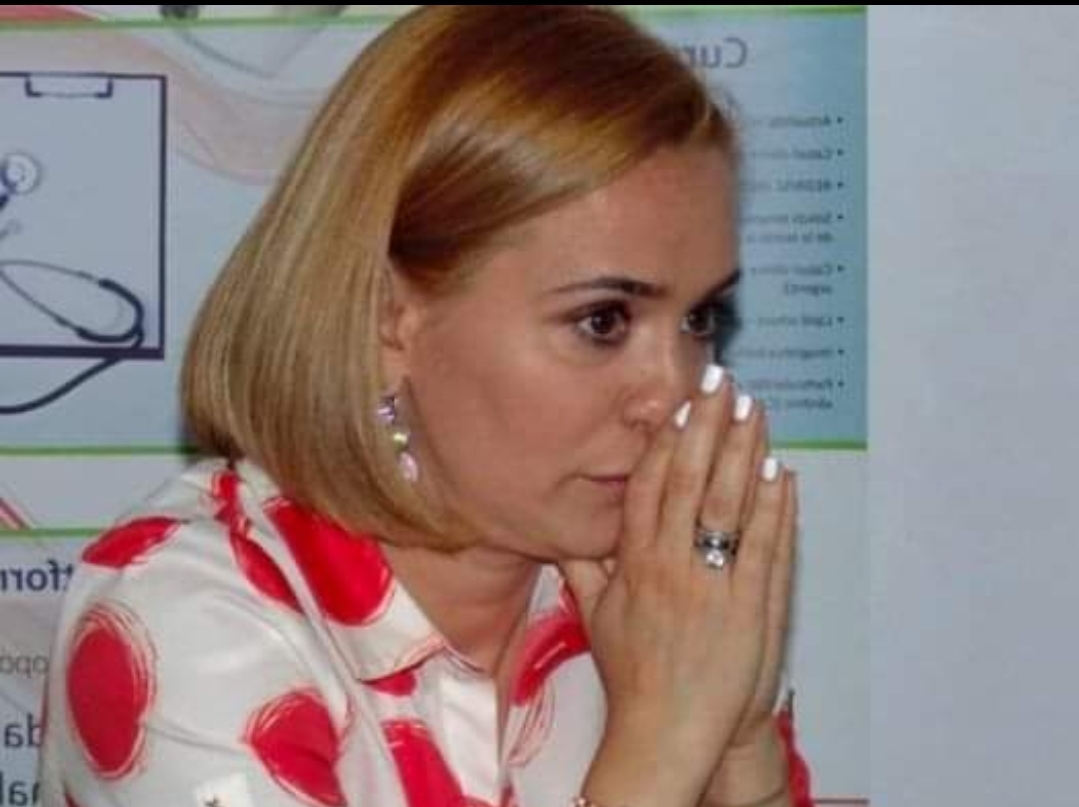

Andrew Dodds, banking and finance partner at Stevens & Bolton, comments that:

„It is not entirely surprising that the government has announced a new scheme to replace BBLS, CBILS and CLBILS to provide support for businesses as they seek to recover from the pandemic. The chancellor’s announcement will be welcome news for many businesses in need of continued financial support. In particular, the removal of the turnover restriction and the increase in maximum loan size up to £10m will enable many businesses to potentially access a larger amount of debt finance. That said, businesses borrowing under the new scheme will now have to pay interest themselves from day 1 and the extra information to be published by the government on the RLS will need to be examined carefully. Nonetheless, the chancellor’s announcement is a positive signal that businesses will not see a sudden withdrawal of government support as some green shoots of economic recovery from the pandemic begin to appear.”